Milestone reached: 1,000th mortgage recorded in Detroit for 2018

The number of mortgages secured is an important sign for the health of a city's housing market. In Detroit, that number has been steadily rising and reached 1,000 for the first time in many years.

One of the best ways to track the health of a housing market is by how many mortgages banks are providing. It gives a solid indicator not only of how many houses are being bought and sold, but also how confident banks are in a local economy and buyers’ ability to repay the loan.

For years, banks have been resistant to providing mortgages in Detroit, making it more difficult for people with less savings to buy houses. That’s beginning to change.

This year, for the first time in many years, Detroit recorded its 1,000th mortgage in November. It’s likely to reach 1,100 by the end of the year.

The Detroit Land Bank Authority has been monitoring home sales in Detroit for years. According to its records, in 2014, only 490 out of 3,742 home sales, or just over 13 percent, secured mortgages. And those numbers were surely lower in the post-housing bubble years.

Total home sales have risen slightly over that time. So far there have been close to 4,000 home sales this year.

Overall, this is extremely positive news for the city, and more importantly, its residents. “The key for me is the opportunity this creates for existing residents in the city’s neighborhoods,” says Robert Linn, assistant director of inventory for the Detroit Land Bank Authority, who noticed the milestone. “Home equity is a powerful financial tool for residents, allowing them to build wealth, save money through refinancing, and accomplish other life goals.

“I think it’s fair to say the city’s come a long way — the number of mortgages has doubled in five years,” he adds. “It’s also fair to say that there’s a lot more work to be done. In order to be on par with many cities in the state, we need to see even more mortgages spreading to even more neighborhoods.”

Lansing, for example, which has a population of just over 100,000, had a similar number of mortgages to Detroit.

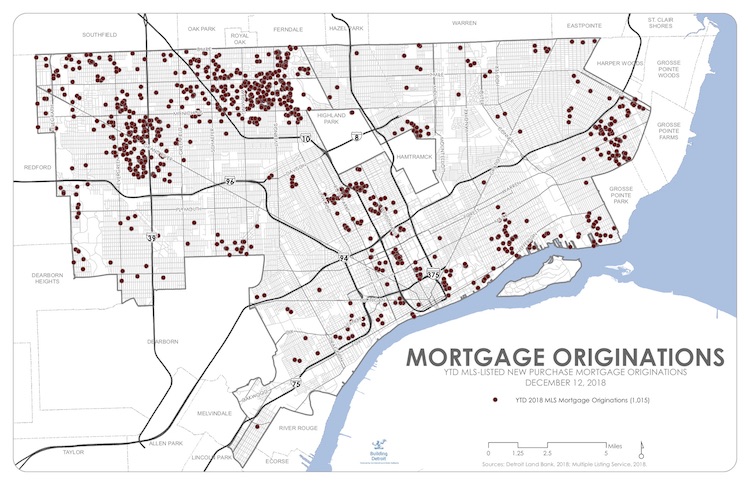

Not surprisingly, mortgages were concentrated in some of the city’s strongest neighborhoods, such as the Villages, Palmer Woods, and the University District. And while a critical mass hasn’t been reached in less stable neighborhoods, there’s still mortgage originations scattered throughout the city.

“Hot spots emerge on the map that previously hadn’t had mortgages in many years,” Linn says.