Throughout Michigan, there are more than 55 community development financial institutions, with 47 of those CDFIs headquartered in the state. These mission-driven financial institutions provide support for consumers, businesses, and real estate projects where traditional funding isn’t available.

By providing resources to small and micro businesses, mixed-used properties, affordable housing, workforce development, and consumer and mortgage lending, these CDFIs have a tangible impact on the communities they serve. CDFIs help create economic opportunities for all, and are certified by the CDFI Fund, a division of the U.S. Department of Treasury.

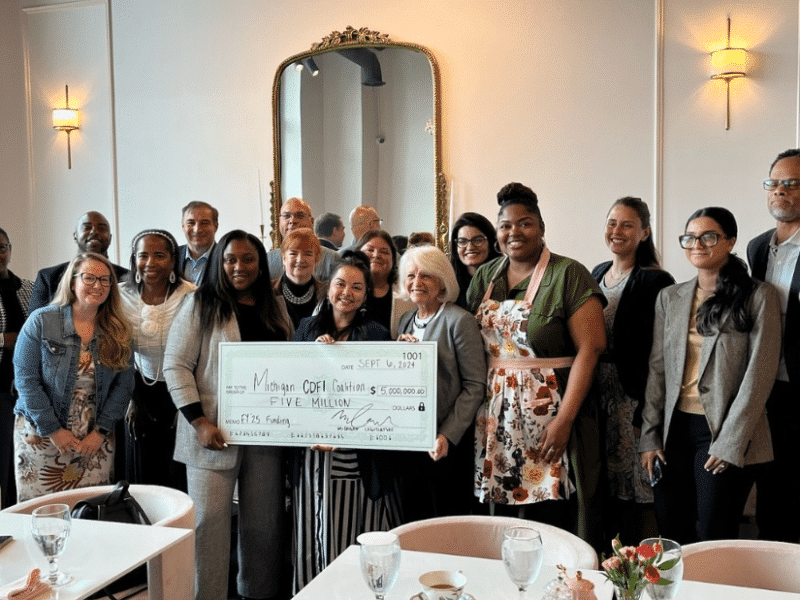

Launched in 2023, the Michigan CDFI Coalition was created to help grow the work, programming and lending provided by CDFIs across their communities. Together, members help advocate for critical policy priorities, further collaboration, share best practices, and catalyze growth for small Michigan-based CDFIs.

Individual cities recognize how their measurable progress can be greater by working together too, creating their own hyper-local CDFI coalitions. The Detroit CDFI Coalition was launched in 2014 to create a stronger Detroit by promoting community development, stimulating growth, promoting local employment and revitalizing neighborhoods.

Since the nonprofit’s inception, the Detroit CDFI Coalition has grown to include over 30 members and has invested more than $1.8 billion in Detroit neighborhoods collectively. Together, they have leveraged more than $221 million in additional investment, deployed $75.5 million in loans, originated more than 2100 loans, provided 1400 consumer loans, more than 140 small business loans, created 694 affordable housing units and 1.5 million square feet of real estate development.

Senior Vice President of Public Policy at Invest Detroit, Jennifer Hayes is also the Chair of the Executive Committee Coalition Board for the CDFI Detroit Coalition.

Left to Right: Jennifer Hayes, Lucius Vassar and Paul Jones

“Invest Detroit is the largest headquartered CDFI in Michigan,” Hayes says. “Last year, we deployed about $46.6 million, which leveraged an additional $271 million, and we supported over 60 projects for small businesses in the city of Detroit. That includes almost 700 jobs and almost 250 housing units in the city of Detroit. Collectively, since our inception, we’ve deployed over $640 million in the city of Detroit, helped build over 6,000 units and have leveraged over $4.5 billion with our capital.”

While each CDFI has a little different focus for their respective locations, Invest Detroit focuses heavily on two areas.

“We focus on growing density in the city of Detroit, and growing jobs. When we’re looking at the types of businesses and projects we’re supporting, we’re hoping to build places where people want to live and have access to jobs that they want to have in those communities,” Hayes says. “Whether it’s jobs through the small businesses we’re supporting, construction jobs in the buildings we’re building, or within some of the larger deals we do — we really want to see livable wage jobs in the manufacturing and industrial types of companies. We provide capital to those types of operations too, looking at jobs in a lot of different lenses here at Invest Detroit.”

As part of the Detroit CDFI ecosystem, Hayes says Invest Detroit works closely with other CDFIs and community partners in a variety of ways. Together, they collaborate on co-lending, building real estate programs, investing in small business loans, and sharing the risk/debt within individual projects. One example of a collaborative project is LaJoya Gardens Apartments, with two CDFIs providing loans for the project, from Invest Detroit and Cinnaire.

Invest Detroit has worked with Cinnaire, a nonprofit CDFI partner with over 30 years of impact and change through their hands-on, people-first approach. In addition to La Joya Gardens, other collaborative co-lending projects reside within the Grandmont Rosedale Neighborhood.

“The Detroit CDFI Coalition is just another example of the trust that this community has built together,” Hayes says. “We’re incredibly collaborative and have that partnership focus. We do a lot of things together in addition to the co-lending and programming, we advocate together, build policy ideas and share best practices. There’s that day-to-day lending side of it, but we’re also making sure each other is successful in the ecosystem and growing our lending capacity in our organizations.”

Outside view of La Joya Gardens

One of Hayes’ favorite Invest Detroit projects is a redeveloped building with commercial and retail space and housing units in the Livernois McNichols Corridor.

“It’s called Lily’s and Elise Tea Lounge, owned by Kimberly Fisher, the only female Black tea sommelier in the state of Michigan,” she says. “It’s a great example of that two-fold approach of how we worked with the developers side of it, but then also the small business side of it as well.”

Growing up in a family small business, Hayes knows firsthand the challenges that come with that.

“Seeing a person have a dream of owning and starting a business and having our team be able to help make those dreams come true, being at those ribbon cuttings, visiting them six months and a year later — it’s really impactful work,” she says. “Especially when you start to see these commercial corridors have multiple redevelopment projects and success stories. I love seeing the community excited about their neighborhoods, it means a lot to the owners and to the communities too. You’re seeing really positive change throughout the neighborhoods and the city.”

Providing that ‘yes’ to an entrepreneur with an idea after they’ve heard ‘no’ from traditional financing sources, can make all the difference, says Hayes. Whether it’s a new park, a business, or apartments popping up in a neighborhood that hasn’t seen any construction in decades, the energy is palpable.

“It’s amazing what that ‘yes’ does for someone’s goals and those dreams, and it’s fun to be part of that team doing that work,” she says. “We have this philosophy in the CDFI space that we don’t like to say ‘no,’ we say ‘not now.’ If you’re not ready, we look at how to get you ready. That is a big part of our work.”

Lucius Vassar is the chief legal officer and corporate secretary for Cinnaire, and is responsible for managing legal affairs with intra-organizational transactions and external councils in markets across nine different states. Vassar also manages policy and advocacy work, leading state and federal advocacy work in affordable housing and community development.

Left to Right: Paul Jones, Jennifer Hayes, and Lucius Vassar inside La Joya Gardens

“Cinnaire focuses on empowering and supporting communities through access to lending capital or equitable investments in community development to assist in making sure that people have access to safe, clean, affordable housing,” Vassar says. “We look for opportunities to partner with community organizations to add value through resources that we have available to us to serve communities.”

Vassar says working closely with other CDFIs in the Coalition shows how local collaborations by committed partners can be beneficial.

“We have a very collaborative approach where if we’re not able to finance, we make referrals to other members of the CDFI Coalition,” he says. “All members of the CDFI Coalition know what the other members do and who to go to for certain opportunities. An organization might be approached initially, but they end up sharing the opportunity and being collaboratively funded by multiple CDFIs.”

“At the end of the day, the best way to benefit communities is by working together. It reminds me of the African proverb that says if you want to go quickly, go alone but if you want to go far, go together,” Vassar adds. “The Detroit CDFI Coalition will continue to go far because we go together.”

While the immediate impact is local to Detroit neighborhoods, the successful collaborations can also serve as a model for other areas in the country, creating amplified outcomes.

“The depth, breadth and intentionality that I’ve seen in Detroit stands above what may exist in other communities,” Vassar says. “I also think it provides a strong model, and we have shared our experience with other CDFIs in other parts of the country to advocate for this type of collaboration.”

This Detroit resident loves seeing the various communities around the 7-Mile and Livernois area coming together to support projects like the Livernois Avenue of Fashion.

“It demonstrates that there is tremendous value, strength and importance in community-led, community-advanced development,” he says. “The people that live in these communities know best what the community needs and have that vested interest to see projects succeed.”

Paul Jones is the chief executive officer of ProsperUs Detroit, a CDFI created to support entrepreneurs with opportunities and capital for building businesses, creating generational growth and growing vibrant neighborhoods.

Paul Jones

Jones has a background in finance and over 15 years of experience from being an entrepreneur himself. After learning more about how each CDFI plays a unique role in the larger ecosystem, Jones became more interested in professional roles that create that tapestry of a supportive community.

“There’s a saying that if you’ve seen one CDFI, you’ve seen one CDFI because they’re all totally different,” Jones says. “Some CDFIs focus on housing, real estate, small business lending, and a very small portion focus on venture capital. We at ProsperUs, focus on small business lending. Our roots are in the community development space. Over time, we have become more of a pronounced and formidable financial institution. A big portion of what we do is provide support for capital readiness — technical assistance is the industry term. We provide training to the entrepreneurs and one-on-one support for entrepreneurs.”

The big goal of ProsperUs’ work is to help democratize the idea of entrepreneurship, says Jones. While each neighborhood might have communities full of grit, determination, innovation and leadership characteristics, not every neighborhood has equal resources to capitalize on those assets.

“Our role and goal is to find the most under-invested communities,” he says. “We think about the people and places, and provide them with the resources, training, and capital so they can start to grow and scale their business.”

The first step in doing so is by building trust in the community. Having a great track record helps for that, as ProsperUs was the most active CDFI micro-lender in Detroit, according to Jones.

“Last year, we approved over 80 loans and that represented about $2.4 million,” he says.

One of the success stories Jones is most proud of is ProsperUs’ work with the Freedom House Detroit, a physical location where asylum-seeking refugees take residence while their citizenship cases are filed. ProsperUs provided entrepreneurial training here before the pandemic.

“There was one person in particular who came from the Democratic Republic of Congo,” Jones says. “He wanted to start a cleaning company and went through the ProsperUs training. He started doing some freelance work on the side, and came to ProsperUs saying he took the course two years ago and was ready to launch. We provided him with his first loan so he could focus on his business fulltime, and also provided him technical assistance on invoicing and accounting. He grew that business from nothing, and started to employ other people who were coming out of Freedom House, providing them with pathways.”

Not only does ProsperUs offer a nonpredatory source of capital, but they also provide valuable wraparound support services.

“What we also provide is social capital,” Jones says. “If you didn’t grow up in a wealthy community or upper middle class, you may not have ever engaged with an accountant, or stepped foot inside a bank to have a relationship. You may not have a legal person who can review your lease. That social and community capital are both really important. We’re really intentional about providing that from an entrepreneur standpoint.”

It’s that long-term deep investment that these Detroit CDFIs have for their local residents, businesses, jobs, and housing in the community that sets the stage for many fruitful and deeply impactful developments.