To fix the foreclosure crisis, we first have to understand it

A home foreclosure crisis has gripped Detroit for over a decade. In the first of two articles, David Sands delves into the extent of the crisis and the people working to understand it.

A foreclosure crisis has gripped Detroit for over a decade. And with thousands of homes for sale in this year’s Wayne County Tax Auction, the crisis is far from over. But awareness is of the problem is growing, more people and organizations are rising to address it, and a significant dip in the number of foreclosures this year represents crucial, if long overdue, progress.

This article is the first in a two-part series on the people working to understand and ameliorate Detroit’s foreclosure crisis. Read part two here.

Like far too many people in the Motor City, Walter Hicks is worried about the prospect of losing his home—a three-bedroom colonial on Robson Street on Detroit’s west side—due to an inability to pay property taxes.

“It means everything in the world to me,” he says of his home. “That’s what a man works for, to one day own his own house, pass it down to his children. But at the rate the city is going, nobody’s passing nothing down.”

A former quality engineer with the Bing Group, he bought his residence in 2012. Now disabled and living on a $15,000 yearly income, Hicks tried getting a poverty exemption for his property taxes from the City of Detroit, but those attempts haven’t really gotten anywhere.

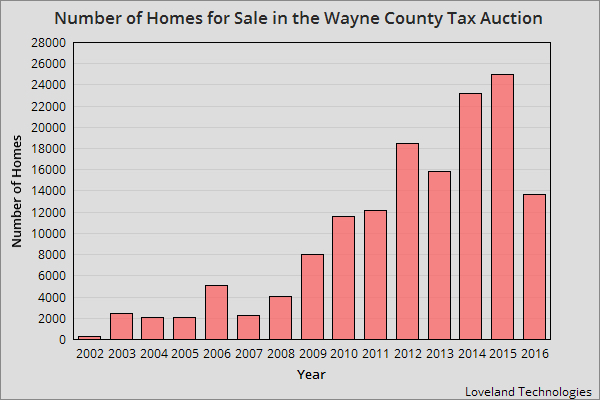

Hicks’s situation is hardly unique—Detroiters have had their homes foreclosed at an alarming rate over the past decade. 13,712 Detroit homes are expected to go up for sale in the Wayne County Tax Auction this September, an estimated 90 percent of which are occupied.

Fortunately for Hicks and folks like him, there are hopeful signs. Many individuals and organizations have identified foreclosures as a major problem, including the head of the office responsible for issuing foreclosure notices, and are working on behalf of homeowners. And while there’s still thousands who are in danger of losing their homes, new data suggests the tide is turning.

The extent of the problem

The numbers of foreclosed Detroit homes in the tax auction have been abysmal since the collapse of the subprime housing market in 2007-8 and somewhat startling even before that. The city’s foreclosure woes are linked to the national foreclosure crisis that hit the U.S. at that time, largely caused by banks making risky loans to low-income borrowers who couldn’t afford their mortgage payments when the economy dipped.

Jerry Paffendorf, CEO of the real estate data company Loveland Technologies, estimates that there have been more than 150,000 tax foreclosures in Detroit since Michigan’s Public Act 123—a law that deals with the auctioning of tax-delinquent properties—went on the books in 1999.

“Massive, shocking, unbelievable, unprecedented, destructive” are the words he uses to describe the situation.

“Tens of thousands of these were likely occupied homes,” he says. “We all get used to high numbers of bad things in Detroit, but we should un-become used to this immediately. There are solutions.”

Mary Byrnes is familiar with both the big picture and the everyday realities of foreclosure here in Detroit. As an Associate Professor of Sociology at Marygrove College, she’s researched and taught about the issue. It’s a heartbreaking situation, the professor says, that has devastated individuals, uprooted families and left neighborhoods decimated.

Working with the activist coalition Detroit Eviction Defense (DED), she’s also become well acquainted with individuals facing eviction.

During her time with the coalition, she documented the stories of 25 people and gathered around 100 hours of footage. The folks she spoke with include homeowners dealing with a wide variety of foreclosure issues, not just tax foreclosure, but also banks foreclosing on folks who couldn’t keep up with their mortgage payments.

Based on what she’s uncovered, Byrnes believes the underlying problems will persist until people put pressure on institutions to change the way they operate. “We need to start looking at the policies that allow the government to put people out of their homes [and figure out] how to systematically work with people.”

Though late to get started, that process is now underway in earnest. Even at the municipal level.

Shifting circumstances

There is no shortage of reasons for despair when it comes to the Motor City’s foreclosure situation, but recent developments are encouraging.

Hicks has joined a class-action lawsuit filed by the ACLU of Michigan and NAACP Legal Defense and Educational Fund that challenges the way foreclosures have been handled by the City of Detroit and County Treasurer—particularly the way taxes are assessed and the disproportionate impact that the process has impacted people of color.

Under Michigan law, municipalities are required to tax homeowners based on the fair market values of their homes, which are determined through annual assessments. According to Michael Steinberg, legal director of the ACLU of Michigan, plaintiffs in their case have been charged four, seven, sometimes eleven times the amounts they should have been paying. Furthermore, low-income people who meet federal poverty guidelines are excused from paying property taxes by federal law.

A recent U.S. Supreme Court decision also that holds that under the federal Fair Housing Act it isn’t necessary to prove intentional discrimination, just that a municipality’s practices have an unjustified disparate impact on people of color. The ACLU and NAACP are claiming the policies of the Wayne County Treasurer are having exactly that sort of impact.

“The foreclosure rates range between 10 and 15 times that of foreclosure rates and census tracts that are mostly white,” says Steinberg. “There’s no legitimate justification for that when the reason for the foreclosure rate is based on illegal taxes in excess of what should lawfully be charged.”

In Hicks’s case, an appraisal of the fair market value of his home calculated its worth to be $9,000. But a 2013 appraisal by the city estimated its worth at more than $40,000—a difference of $31,000 that puts his past taxes from 2013 and earlier at more than $1,800.

This difference has the potential to alter the dynamics of foreclosure in Detroit by reducing property taxes to manageable amounts. The Wayne County Treasurer’s office wouldn’t comment on the allegations as the lawsuit is still pending.

Another more immediate signal that circumstances may be shifting is the fact that the number of tax foreclosures in Detroit has dropped substantially from last year.

According to data provided by Loveland Technologies, the number of foreclosed Detroit properties up for sale at the Wayne County Tax Auction jumped from 2,251 in 2007 to 4,096 in 2008. Except for a minor dip in 2013, the figures continued to climb all the way up to 24,992 in 2015. Thankfully, those numbers have dropped precipitously this year, down to 13,712 as of July, a decrease of roughly 45 percent.

Part of the dip is attributable to the Detroit Land Bank, which came online in 2014 and took over roughly 5,000 unsold properties from last year’s auction, according to the Detroit Free Press.

The new Wayne County Treasurer’s office has also been taking a more proactive response to the situation due to a recent change in leadership. In April, Eric Sabree was appointed to replace his longtime predecessor Raymond Wojtowicz, who held the position for 39 years.

Kim Homan, deputy treasurer of Land Management with the agency, says that even under his previous role as deputy treasurer, Sabree was pushing the office to take steps to keep people in their homes like “offering special payment plans, extending deadlines and supporting legislation to lower the interest rate on forfeited property taxes.”

This year, Sabree has undertaken numerous initiatives aimed at curbing foreclosures, including:

- extending the deadlines for all foreclosure prevention programs to June 30, as opposed to the April 1 date most county treasurers use to stop accepting payments

- funding a door knocking program targeting nearly 9,000 occupied residences in Detroit, Hamtramck, and Highland Park to educate residents on their foreclosing tax status and foreclosure prevention options

- hosting several foreclosure prevention events after hours and on weekends, in partnership with several municipalities and other foreclosure prevention organizations

- having members of the Treasurer’s Customer Service and Taxpayer Assistance teams make phone calls to taxpayers who were not in compliance with their payment agreements

- appearing on a number of public service announcements and television shows to raise awareness about the foreclosure process

This past June, surveyors hired and supervised by Loveland Technologies (who were commissioned to do so by the Treasurer) conducted the agency’s door knocking program, which involved educating and gathering information from residents facing foreclosure. Altogether, they visited 8,745 foreclosed residences and made contact with 1,789 occupants—at least 256 of whom enrolled in payment plans after the visit.

Loveland CEO Jerry Paffendorf is heartened by this year’s decrease in residences at the upcoming tax auction, as well as the new Treasurer’s proactive approach.

“I would say that the big trend is how the Treasurer’s office is embracing new approaches like better data, better websites, door to door surveys, early outreach, community engagement and counseling, and working through traditional political channels to create better policy,” he says.

He also feels the City of Detroit is becoming more “aware and helpful” in its outreach to residents. These developments, combined with the new attention ACLU-NAACP lawsuit is bringing to the foreclosure crisis and his own company’s efforts to bring greater transparency to the issue, give him hope that the situation may eventually be resolved.

That said, though, Paffendorf is still very concerned about what happens in the immediate future, noting that “there are tens of thousands more properties [that could be] foreclosed in 2017 if homeowners don’t get on payment plans by the spring.”

Homes owned by people like Walter Hicks.

All photos by Nick Hagen.