For metro Detroit families, financial literacy can be the difference between poverty and stability

For the working poor, it's not enough to be employed. An innovative program is helping people reach financial stability by learning how to manage their money.

When Ramone Horst lost the job he loved working for National Air Cargo at Detroit Metro Airport in the midst of the 2008 financial crisis, he was without a college degree.

“I call myself a product of the recession,” he says. “When it hit, I was out of a job, and it was very hard to get back into the workforce.”

At the encouragement of his mother, who was his only safety net, Horst approached Focus: Hope and began participating in a unique program designed to help him get back on his feet. Throughout his engagement with the program, he received employment training and placement assistance, financial counseling, and access to income support resources, such as a micro-grant for a reliable car that made it possible for him to continue working once he found a job.

But according to Horst, the most important service he received was emotional support.

“They were there for me,” he says. “They let me know I didn’t have to go through this alone.”

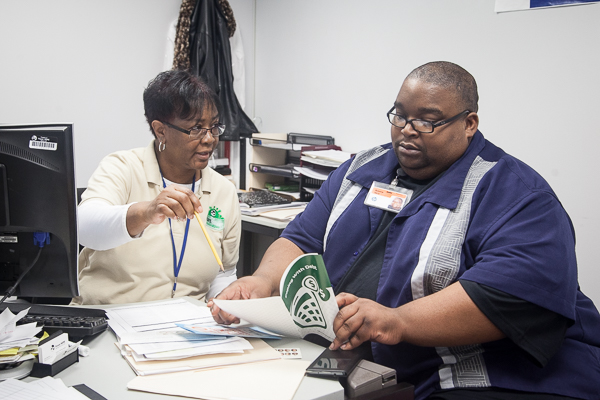

The assistance Horst received was delivered through the Greater Detroit Center for Working Families Network (CWF), a network of nonprofits that works with people to develop financial literacy at 10 locations across metro Detroit. Since its inception, the program has serviced over 7,600 working families. In 2014, 53 percent of the 2,400 individual and family participants in the program realized an increase in their net income and 36 percent realized an increase in their credit score.

The model, part of a larger national network called the Working Families Success Network, offers a triad of bundled services: employment, financial coaching and income support.

It’s the combination of these services that makes the program so effective, according to Jacqueline Burau, senior program officer at Local Initiatives Support Corporation (LISC) for CWF. Detroit LISC and United Way for Southeast Michigan jointly manage the Greater Detroit CWF network.

“There’s a whole myriad of struggles that families and individuals we serve at our centers are having,” says Burau. “The clients that we serve at the 10 sites are unemployed and need help connecting to training opportunities, or they might be underemployed or fully employed, but need assistance on maximizing the funding they’re getting.”

It’s a little like aligning the chicken and the eggs, something Horst can relate to.

“At first, I was like, ‘Why do I need financial literacy classes? I don’t have any money,'” he laughs. “I’m trying to get a job; if I had a job, I wouldn’t have a financial problem.”

But he now credits his ability to maintain financial stability to the skills he learned in the program.

“They broke down what money is, how it works, how you can control it and not let it control you,” he says.

The triad: employment, income support, financial literacy

People across the region face many barriers to finding employment, according to Burau, from driver responsibility fees to childcare support to a history of incarceration. And even once employed, many families and individuals struggle to make ends meet. The Michigan Association of United Way’s Access Limited, Income Constrained, Employed study demonstrated that in Michigan, 60 percent of all jobs pay less than $40,000 a year, and 40 percent of households struggle to afford the basic necessities. So while employment can help people start to generate income, often the income is less than what is required to be financially stable and income support is still needed to help with things like food, clothing, and transportation. The media incomes in Wayne, Oakland,Macomb and the city of Detroit fall below the level ALICE considers required for financial stability, according to an infographic and data reported by WDET.

But the financial coaching aspect of the program is critical to maintaining stability, according to Burau, because it provides the skills that many who have struggled with low income may never have had a chance to learn.

For the first time, participants are answering questions like, “How do you make a budget? How do you prioritize how you’re spending your money? What does your credit score look like?” says Burau. “The results speak for themselves. When folks receive these bundled services, they increase their income, their net worth and their credit score.”

Evidence supports the success of the bundled approach. A 2014 Economic Mobility Corporation study found that workforce training clients who had also received financial counseling were more likely to be on time with their bill payments.

In Detroit, says Martinez, the need for that training is great.

“People in Detroit need financial literacy,” she says. “This business model is a way for people to access financial resources, either while they are on their journey to get employed, or during their employment, to learn how to maximize the resources or their income. And in instances where there’s no income, they’re optimizing how they are making decisions with their income support resources, so they can meet their basic needs until they have more financial stability.”

Serving unique community needs

Local CWF nonprofits are selected based on a strong history of serving their local communities.

“All 10 of our programs are located within high-performing nonprofit organizations that are rooted in their communities,” says Burau. “They are organizations that have been serving their communities for a long time.”

Local programs are also tailored to the unique needs of the community in which they are located.

“For example, SER-Metro and Southwest Solutions are located in predominantly Spanish-speaking areas,” says Martinez. “So they serve that demographic, while ACCESS Macomb County, while they serve everyone, has a primary focus on the refugee population that has flooded into Macomb County, whereas ACCESS Dearborn primarily serves a population of Arab Americans. And Operation Able in Detroit serves the aged citizens population, 55 and over.”

While Greater Detroit CWF sites provide services tailored to specific populations, anyone is welcome to receive services at any CWF location.

“Nobody will ever be turned away for services at any site, regardless of your origin or need,” Martinez says.

Horst is thankful to be both making a solid income and applying skills to maintain financial stability.

“What I’m making right now is great for me to survive,” he says. “I’m able to pay my bills and be self-sufficient.”

—

Support for this feature was provided by Detroit Local Initiatives Support Corporation (LISC). Special thanks to Anita Martinez of United Way for Southeastern Michigan, manager of the Greater Detroit Centers for Working Families, for her contributions to this story.

Nina Ignaczak is a metro Detroit-based freelance writer. She also serves as digital editor for WDET 101.9FM. Follow her on Twitter @ninaignaczak.