Banking on Southwest’s Spirit

Detroit’s first

minority-focused, state chartered bank in more than 30 years is getting ready to open in Southwest Detroit with the hope to help build up the community around it.

Frederick Feliciano’s family restaurant, El Comal, is typical of the

small businesses that comprise the economic engine of bustling

Southwest Detroit.

So he knows that restaurants and other small businesses go through lean periods. It’s not uncommon for them to seek a small loan to get through, says Feliciano, who is also president of the

Detroit-based Hispanic Business Alliance.

“The majority of

our businesses are small businesses,” Feliciano says. “They’re looking

for a creative financial partner to address their needs.”

While some major local institutions do well working on neighborhood levels with small companies, not all big banks are capable of or have an interest in handling small business needs. Community banks can help fill in that gap, says Donald Snider, owner of Paper Plas,

a Detroit company that provides recycled paper for manufacturing uses.

Snider has known the difficulty of acquiring capital to finance his business

Snider has known the difficulty of acquiring capital to finance his business

ventures, but never thought about starting a bank until a colleague

suggested it.

“I went to

the Hispanic community and said, ‘I’m thinking about starting a bank,

what is your need?’ ” They told him they needed micro loans, sums between $25,000 and $50,000; but many banks only wanted to offer big loans,

from $500,000 to $1 million.

Snider sensed an opportunity and decided to form a

community bank in Southwest Detroit.

First Spirit Bank will be dedicated not only to providing small business loans,

but to educating the community to become better money managers. The bank, which has been approved by the Federal Deposit Insurance

Corporation, is scheduled to open this summer in Southwest Detroit, at 3633 Michigan Ave., near West Grand Boulevard.

It will be Detroit’s first

minority-focused state chartered bank in more than 30 years. The bank

will be managed by minority staff and will be bilingual. Snider expects

that First Spirit Bank will issue about $6 million in loans of $25,000

to $50,000 during its first year of operation.

“A

“A

community bank is a little leaner, a little more aggressive in

addressing the needs of small businesses because they’re in a similar

boat (as a small business),” says Feliciano, who has been appointed to

First Spirit Bank’s board of directors. “The Hispanic consumer is very

loyal to a product or a service. If we can come up with creative ways

to develop micro loans so businesses can sustain themselves in periods

of struggle, that, in turn, makes them a loyal client … . It may be a small loan, but they’ll come back for a car loan, a

conventional mortgage and other financial needs. From that standpoint,

I think there is tremendous opportunity.”

Feliciano says that

opportunity extends to penetrating the African-American and the Arab-American communities, where “there is some of the same demographic,

cultural, economic, and consumer ethnic markets.”

There are

community banks in metropolitan Detroit, but none serving Southwest

Detroit. Feliciano finds that ironic, given the fact that the

area shows some of the strongest evidence of Detroit’s residential and economic

revival. “In the midst of all the doom and gloom that you hear, whether

it’s from prognosis, speculation, or financial realities, there is a

story of opportunity and growth in the city focused around this diverse

population,” he says.

“The city has lost significant demographic

representation in the last couple censuses, but the one area where

they’ve seen substantial growth is in Southwest Detroit.”

Helping to create opportunities

Snider, born in Detroit, but raised

and educated in other cities, returned to the city shortly after the

1967 riot. He found that the city’s racial polarization made it that

much more difficult for him to start a business here. He realized early

on that “folks in Grosse Pointe have the money and we need to have

access to those relationships to participate in the positive stuff

that’s going on (in business). Finally, step by step, I got to the

relationships that I needed.”

Detroit’s minority business community needs to have better access to capital and know how to use it so they are not left behind, he says. “You need a

good (fiscal) foundation,” Snider says. “A lot of our companies don’t

have a good foundation of how to manage their money.”

One of the core

One of the core

objectives of First Spirit Bank will be providing financial education

in the community. Snider is already doing that for civic and church

groups. Young people who don’t learn about money management or how to

maintain good credit are put at a disadvantage when shopping

for loans to start a business. “They’re coming out with the wrong

habits,” he says. “That’s why I travel around the country giving

speeches about building wealth. I tie it into biblical terms; I tie it

into everyday stuff on what you need to be a success.”

Backbone of progress

While

its mission is to become a community lending partner for businesses and

individuals, First Spirit Bank will also support community development. Its presence in the community will also be an asset. “You need to stimulate certain pockets of Detroit

to get it going. When you put a bank in a community, it stimulates

interest in that community. You may get other retail business that want

to move next to you.”

Snider and Feliciano each see good

business opportunities in cultivating a population of entrepreneurs and

homeowners in Detroit’s minority communities through First Spirit

Bank. Without becoming too idealistic, Snider recognizes the symbolism

in his bank’s name. “We want to tap into the spirit of Detroit, the

spirit of the individual, the spirit of the loan,” he says.

Feliciano

views this symbolism as something that can be applied to everyday life,

as a reminder that the economic engine is still running: “When you talk

about the city of Detroit and the image of the Spirit of Detroit as a

symbol of Detroit overcoming obstacles, and being the backbone of

progress in this country,” he says, “and when we talk about First

Spirit Bank of Detroit, it embodies what Detroit has meant in the

industrialization of America, and how that spirit is still alive.”

Dennis Archambault is a Detroit-based freelance writer.

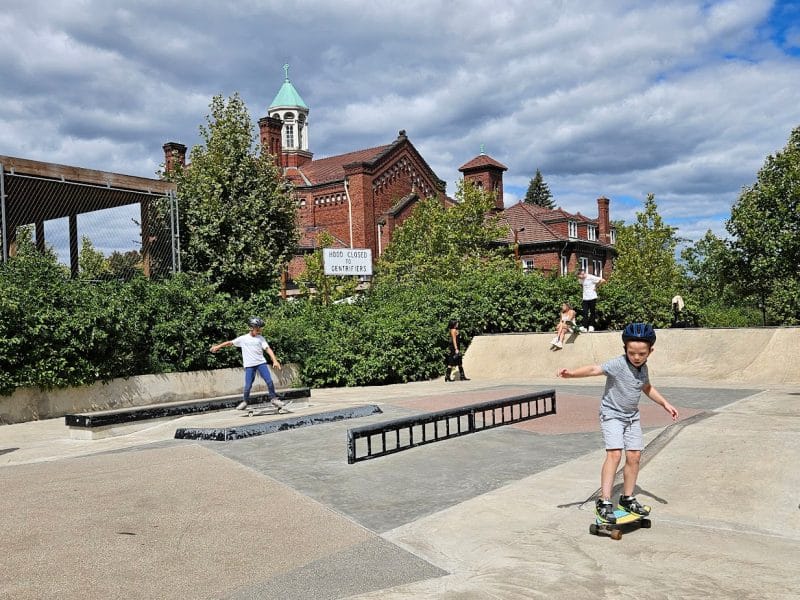

Photos:

Site of the First Spirit Bank

Don Snider

El Comal

El Comal

All Photographs Copyright Dave Krieger